Three alternative distribution models are available

The interest among foreign shippers to start selling their products on the European market is high and rapidly increasing. Annual figures from NDL/HIDC, responsible for representing and promoting the Dutch logistics industry, show stable double-digit growth figures for foreign logistics investment projects.

Meanwhile, more than 1,000 American and Asian companies have already centralized their European distribution activities in the Netherlands. It is important for foreign shippers at the start of this journey to be aware of both the alternative distribution models that are available as well as the processes that need to be set up before they can start serving the European market.

Distribution Model

Companies that are considering selling their products on the European market in general have three alternative distribution model options to choose from.

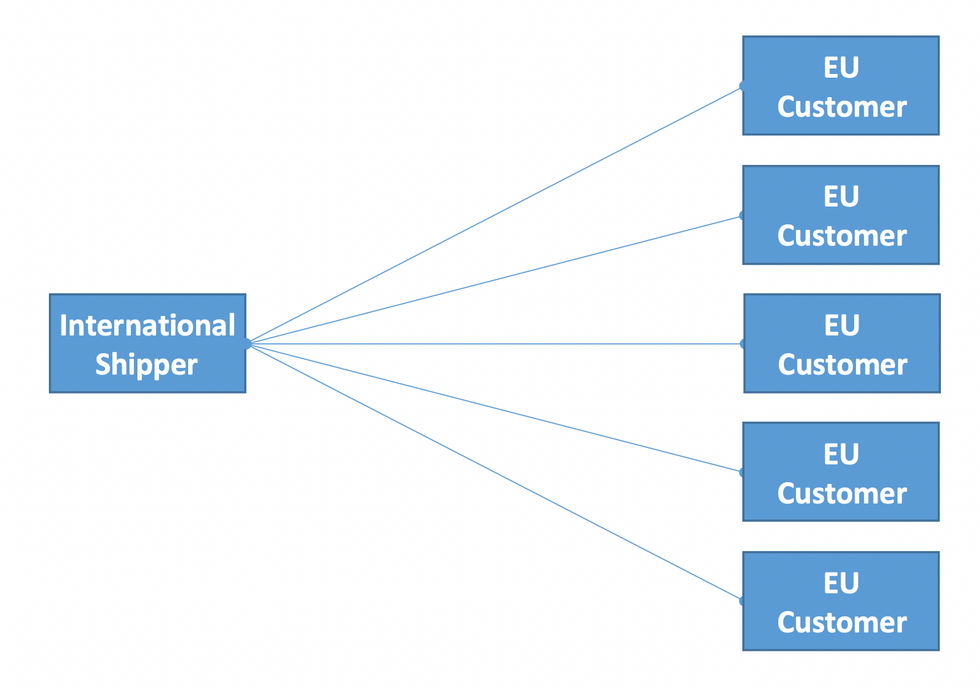

1. Direct shipping from overseas

Companies may decide to sell and supply their products directly from their overseas production or distribution location to their new European customers. Many companies enter the European market applying this approach. It does not require an upfront investment in either an in-house or outsourced European distribution structure, nor does it require building up a relationship with a network of distributors. Clear disadvantages of this model are long lead-times towards customers, high shipping costs, a loss of control and less flexibility.

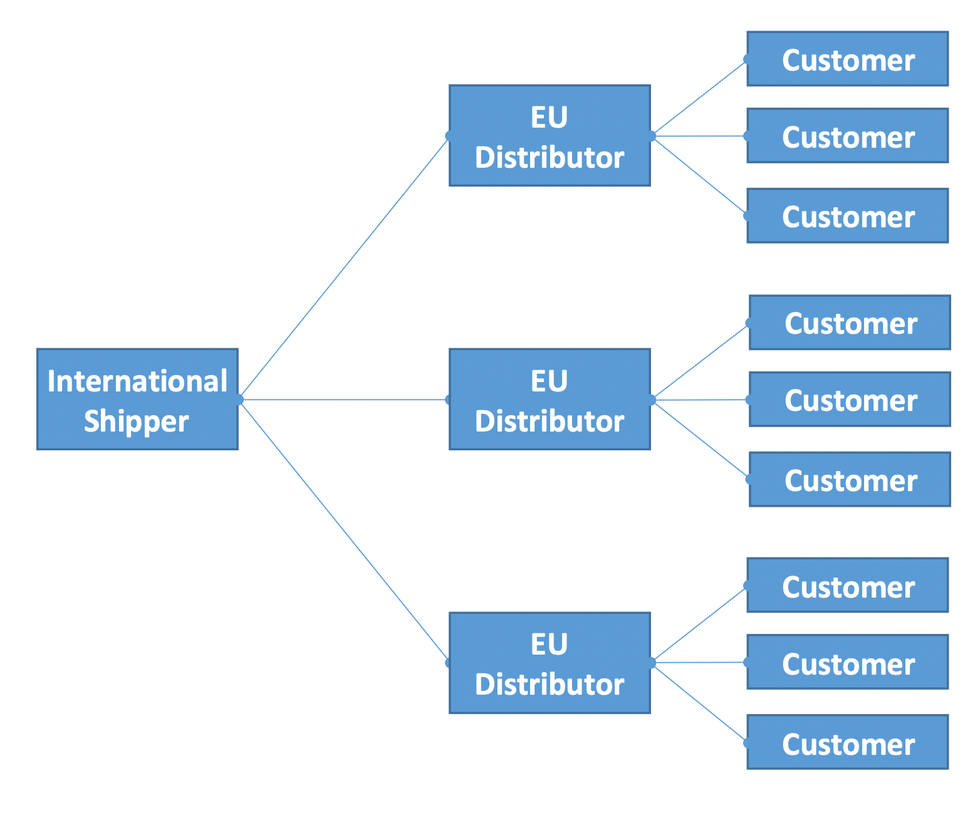

2. Distributor model

Depending on the nature of a company's products, a distributor model may be a viable alternative to direct shipping from overseas. It shifts the European inventory point from the customer to the distributor, offers a significant lead-time and shipping cost improvement and the distributor takes responsibility for part of the commercial activities of the company. Disadvantages are that typically the distributor also takes part of the product margin, that there could be a mismatch between the commercial strategies of the shipper and that of its distributors and that a network of high-quality distributors offering Europe-wide coverage may not be available. Finally, individual intercontinental shipments to a network of distributors are still relatively expensive.

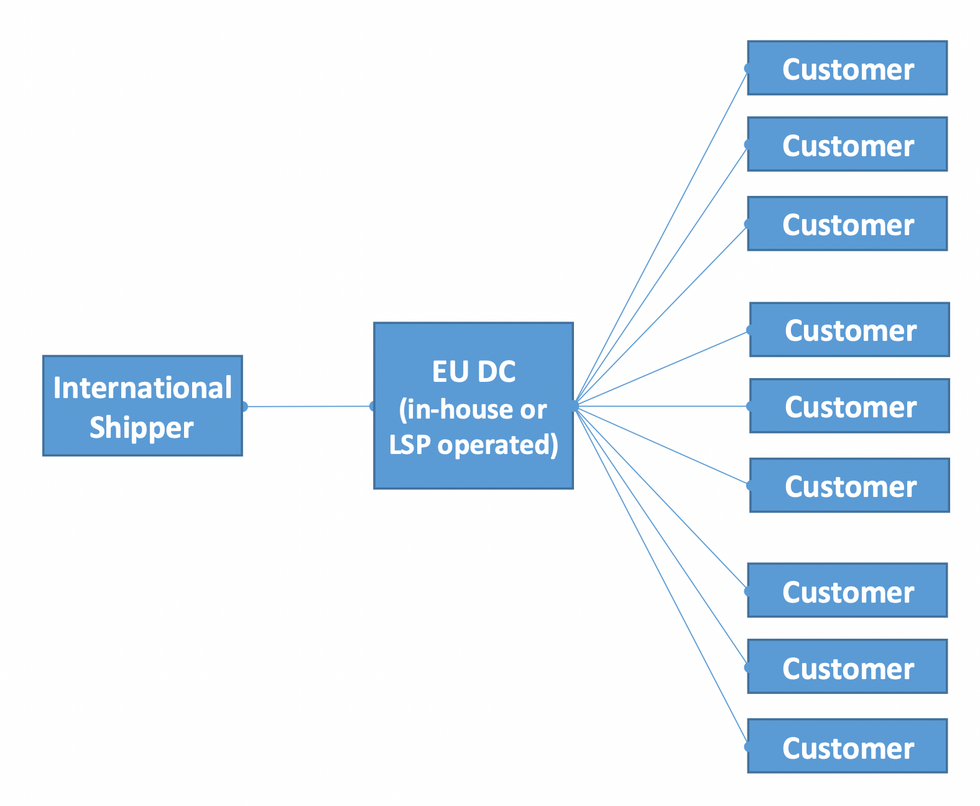

3. Own distribution structure (in-house or outsourced)

Most non-European companies that sell their products on the European market eventually decide to set up their own distribution structure here. This gives the company the ability to supply its European customers quickly, optimize its inbound shipments by creating full container loads, take control over its local inventory and be flexible towards current and prospective customers. Although the company may continue to use a network of distributors, it now also has the ability to engage directly with customers and set up additional distribution channels to boost the company's sales and profits.

The majority of shippers outsource either all or part of their European distribution operations to one or more logistics service providers (LSPs). Warehousing and transportation are the most commonly outsourced logistics services. For every shipper that decides to set up its own European logistics distribution structure, about three shippers decide to outsource it to one or more LSPs.

Outsourcing enables the shipper to make flexible use of labor, equipment and warehouse or trucking space as agreed with its service provider. Outsourcing also provides the shipper with the opportunity to focus on its core activities and to benefit from the best practices of the LSP. If the shipper's warehouse operations are integrated into a shared-user facility, there may also be synergies with the LSPs other customers. A dedicated warehouse setup is more prevalent for larger customer operations of about 10,000 m2 or more. This is also the typical size of a warehouse compartment.

Inbound Freight

Transport by ocean freight is responsible for the vast majority of intercontinental cargo volume. Despite its long lead-times, it offers a relatively low-cost option of moving products, e.g., from Asia or North America to Europe. Considering its high cost, airfreight in most industries is only used for emergency shipments to prevent a plant standstill or to guarantee in-time delivery to a critical customer. Despite recent developments (e.g., with respect to China's Belt and Road Initiative), the use of intercontinental rail transport is still in its infancy.

Large shippers typically contract and book their container shipments directly with the large ocean shipping lines (e.g., APM-Maersk, MSC, CMA CGM). Smaller shippers with occasional full (FCL) or part (LCL) container loads often use freight forwarders to move their freight between, e.g., Asia or North America and Europe. Freight forwarders are able to combine the volumes of multiple shippers and negotiate competitive rates with the shipping lines. In addition, forwarders can physically consolidate multiple smaller shipments into full container loads and book them as such with the shipping lines. Meanwhile, forwarders typically apply volume-based rates towards their own customers, which prevents those customers from paying for space they do not need.

Upon arrival at the European port of entry (e.g., the port of Rotterdam), the goods are unloaded from the containership and transported to a temporary storage facility of the port authority.

In most cases, goods are imported into the European Union upon arrival at the port. In this scenario, either the shipper or its customs representative (e.g., the company's LSP or a dedicated customs agent) creates an import declaration and shares this with the local customs authorities. Shippers can only act on their own behalf towards the local customs authorities if there is a legal establishment in the EU. Upon approval of the import declaration, the customs authorities charge applicable import duties and VAT to the shipper or its customs representative. After payment of these amounts, the goods are cleared for customs and brought into free circulation in the EU.

Subsequently, the applicable carrier can pick up FCL shipments and bring them to the European warehouse of the shipper or its LSP. LCL shipments first require deconsolidation, which typically occurs at a local handling facility in the port area. Goods are unloaded from the container, separated per delivery address and reloaded on a regular truck for delivery to the final destination. A regular shipping document (CMR) should accompany the physical shipment. Shipments containing products that are not yet customs cleared also require a T1 transit document. These products subsequently can be stored in a bonded warehouse.

Reasons to delay the import of goods into the EU include:

- A cash flow advantage on the import duties, as these do not yet need to be paid upon arrival at the port.

- A prevention of double import duty payments when goods are (partly) re-exported (e.g., to Norway or Switzerland).

In addition, foreign shippers that import their goods into the EU via the Netherlands have the opportunity to benefit from the VAT deferment (postponed accounting) scheme offered by the Dutch tax authorities. By appointing a Dutch fiscal representative, they can prevent paying VAT upon import and instead postpone this to the periodical tax return. For B2B sales, this means no VAT payment actually becomes due, as the declared import VAT can directly be deducted. This brings both an additional cash flow advantage and reduces the administrative burden on the company. Most companies appoint their LSP or customs agent as fiscal representative, provided it is offering this service.

Warehousing

Warehouse locations in the direct vicinity of the European port of entry are in high demand. It is clear to see why, as they minimize the time and cost of the drayage or on-carriage between the port and the warehouse. A disadvantage of these locations is that real estate costs in these areas are typically 20 to 30% higher as compared to locations 50 to 100 km further inland. Rental costs as charged by real estate companies and storage rates of LSPs reflect this cost difference. This in part also explains why the main logistics hotspots of the Netherlands are concentrated in the south of the country. Other disadvantages of product storage close to the port of entry are a shortage of skilled logistics personnel and traffic congestion that hinders shipping products quickly towards your European customers.

Inbound

Upon receipt of the goods at the warehouse, a check is typically performed on correctness and completeness (e.g., with respect to quantities, SKUs and lot or batch numbers). In addition, it is important to check the shipment for any irregularities (e.g., damages, deterioration). The scope of the inbound checking process will also depend on the nature of the products and the relationship between the involved parties. A more extensive check may, for example, be applicable for an inbound shipment from a contract manufacturer as compared to a replenishment shipment from an overseas warehouse of the shipper itself.

Other regular inbound activities include product sortation and palletization (if goods are received loose loaded), labelling and put-away, as well as administratively confirming the receipt of goods in the system to make them available for picking.

Storage

It is important that a company's products are stored in a way that minimizes the risk of damages, deterioration and loss. Consider these important aspects:

- A logical overall warehouse design that aligns with the company's products

- A clear location identification method

- Collision protection measures

- Pest and climate control procedures

- Fire prevention and safety measures

- Theft prevention procedures

Products can be stored in a variety of different ways to include block stacking and pallet racking (for full pallet quantities) as well as the use of shelves and bins for smaller product quantities. The optimal product storage method will depend on aspects such as product size, storage quantity and sales volume. Specific storage conditions are, for example, required for dangerous goods, pharmaceutical products and food products.

In the case of bonded product storage, the involved products must be administratively registered and physically identified as such. Although it is possible to store free circulation products and bonded products in the same warehouse, there must be a clear separation between both product types.

It is important to continuously monitor inventory consistency to guarantee there are no discrepancies between physical and system inventory quantities. The use of a cycle counting procedure ensures counting of all storage locations either a fixed number of times per year or every time when picking a storage location empty.

Next to regular cycle counting, many companies also apply an annual full wall-to-wall count of all its products across all of its warehousing locations (in-house or outsourced). Any inconsistencies found during the wall-to-wall count as compared to the company's systems values require a correction. The wall-to-wall count typically takes place as preparatory activity for the company's annual financial reporting cycle.

Outbound

It is important for the shipper to agree on an optimal order communication process, regardless if this is an internal process or directed towards the LSP. In the case of an outsourced warehousing scenario, a variety of different order entry approaches may be used:

- Order transfer by phone and/or email

- Direct entry in LSP solution (e.g., portal)

- Use of an order upload template

- Data transfer via EDI or API connection

The optimal order entry approach depends on various aspects including the existing IT systems landscape and applicable number of orders.

Typical outbound activities include goods picking, packing and labelling, creation of shipping documents (e.g., packing list and CMR, export documents if applicable), call-off with the applicable carrier, checking for correctness, completeness and irregularities, loading the goods in the carrier's truck and confirming the goods issue in the system.

It is common for shippers and their LSPs to discuss upfront relevant service standards including applicable order throughput times, available processing capacity as well as any exceptions to these standards.

Value Added Services (VAS)

A shipper may agree with its LSP to perform any combination of VAS. These are either physical or administrative activities outside of the standard process flow. Examples include repacking (e.g., from retail to consumer pack size), labelling and kitting (e.g., preparing retail display units). In the case of stable handling volumes over a longer period, it may be possible to execute some of this work as part of a social workplace setup.

Returns

Customers may return goods for a variety of reasons, which broadly fall into one of three categories: general returns, warranties and repairs, and end-of-life returns. It is important for a shipper to design and agree with its LSP on a process to follow for either of these categories. This should help minimize the logistics costs of the returns process and maximize both the salvage value of the products as well as customer satisfaction.

Outbound Freight

Depending on the shipment size, customer type (business or residential) and destination address, allocation of a shipment takes place to either the applicable pallet or parcel carrier that is responsible for delivery to the final customer. The tipping point at which pallet transport becomes more competitive than parcel transport may vary per shipping lane and typically lies between one and three pallets.

Pallet shipments may range from small groupage shipments consisting of a few pallets to larger Less than Truckload (LTL) or Full Truckload (FTL) shipments. Groupage shipments are typically cross-docked at one or more carrier hubs prior to shipping them to their final destination, while LTL and FTL shipments move directly from the warehouse to the customer (with possibly a few stops in between).

The pool of parcel carriers that is operating in Europe broadly consists of the following three groups:

- The global players: DHL, UPS and FedEx

- The companies DPD and GLS offering (almost) Europe-wide coverage

- Smaller parcel carriers that are mainly active on the national level (often these are former postal companies)

The pool of European pallet carriers is much larger and more diverse than that of parcel carriers. While there are a number of large European carriers with a fleet size of several thousand trucks and trailers, no single carrier can competitively offer pallet transport across the whole of Europe and for all shipment sizes. Regardless of their size, most carriers specialize on either one or more of the following dimensions:

- Shipment size (groupage, LTL or FTL)

- Geographical coverage

- Temperature regime (e.g., ambient, chilled or deep-frozen transport)

- Product classification (general cargo or dangerous goods)

- Package type (packed or bulk transport)

- Transport equipment (e.g., curtain-sided or box trailers)

The company's LSP often has a good position to overview the local and broader European carrier market provided it is independent and asset-neutral (i.e., it does not offer its own transport).

Conclusion

It is important for foreign companies that are considering entering the European market to prepare for this step in advance by performing a thorough overall evaluation of the alternative distribution model options and logistics process design alternatives. Both should match with the company's logistics and commercial growth strategy to ensure the shipper's European market entry brings the anticipated financial results.

More Information

Penske Logistics Europe

P.O. Box 142

4700 AC Roosendaal

The Netherlands

T: +31 (0)165 576241 (Sales)

T: +31 (0)165 576700 (General)

DISCLAIMER: The content provided is for general informational purposes only. Penske makes every effort to ensure the accuracy of the information presented; however, the information herein is provided without any warranty whatsoever, whether express, implied or statutory. In no event shall Penske be liable for (i) any direct, incidental, consequential, or indirect damages (including loss profits) arising out of the use of the information presented, even if Penske has been advised of the possibility of such damage, or (ii) any claim attributable to errors, omissions, or other inaccuracies in connection with the information presented.

Related Articles

Resource Library

Explore articles, case studies, e-books and industry reports from our logistics experts.

Explore More